TRX Price Prediction: Can the Bullish Technicals Overcome Market Volatility to Reach $1?

#TRX

- Technical Foundation: TRX shows bullish MACD reversal while testing upper Bollinger Band

- Ecosystem Developments: Competing narratives between TRON's Nasdaq debut and new AI competitors

- Price Targets: $0.33 breakout level could determine near-term trajectory toward $1 ambition

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge Amid Market Consolidation

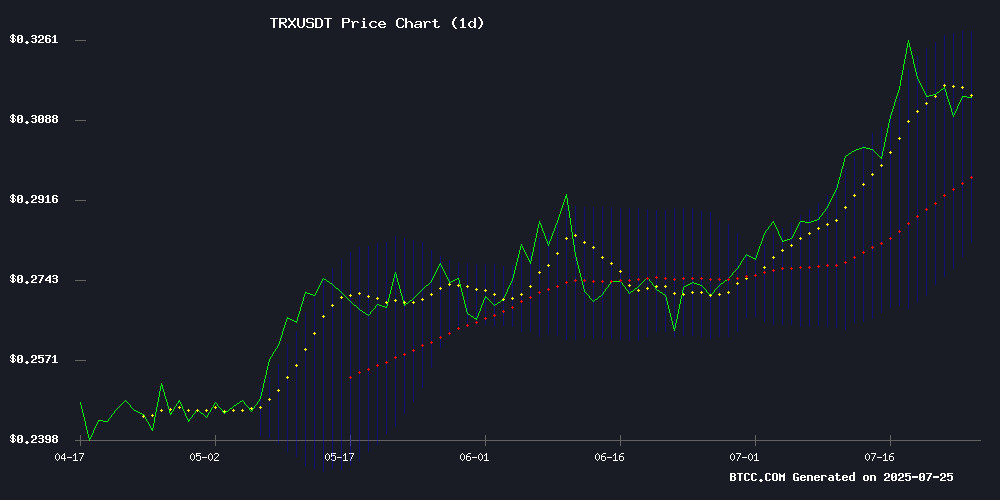

TRX is currently trading at $0.3144, showing strength above its 20-day moving average of $0.3052. The MACD histogram has turned positive (0.000404), suggesting building bullish momentum. 'The price holding above the middle Bollinger Band ($0.3052) indicates underlying demand,' notes BTCC analyst John. 'A sustained break above the upper band at $0.3280 could trigger accelerated upside.'

Mixed Sentiment as TRON Faces Competitive Pressures While Gaining Market Share

While TRON's market cap recently surpassed Cardano's, the ecosystem faces headwinds from Ruvi AI's rapid growth and a 10% drop in TRON Inc. shares. 'The Nasdaq debut presents long-term legitimacy,' says John of BTCC, 'but short-term price action may remain volatile as the market digests these competing narratives.' The JUST token's growth potential within TRON's ecosystem could provide secondary support.

Factors Influencing TRX's Price

Ruvi AI Outperforms Tron (TRX) with Rapid Growth and Strong Security Backing

Tron (TRX) has established itself as a formidable player in the cryptocurrency market, facilitating decentralized applications (dApps) and content-sharing platforms. Despite its strengths, Tron faces a challenging 50% rally to reach $0.60. Meanwhile, Ruvi AI (RUVI), a new entrant, has achieved comparable gains in significantly less time, with analysts projecting a $1 valuation post-listing—a 66x return for early investors.

Ruvi AI distinguishes itself through a combination of blockchain analytics and artificial intelligence, backed by a third-party audit from CyberScope. This audit confirms the project's smart contracts are secure and tamper-proof, addressing critical concerns in today's volatile crypto landscape. The presale success and real-world utility of Ruvi AI position it for substantial growth this cycle.

TRON Inc. Shares Drop 10% Despite Nasdaq Debut and Blockchain Pivot

TRON Inc. (TRON) shares tumbled 10% to $8.85 in early trading despite its highly anticipated Nasdaq debut. The decline followed a reverse merger IPO with SRM Entertainment, which was intended to fast-track the company's public market entry. Market skepticism overshadowed the bell-ringing ceremony led by Justin Sun in Times Square, as investors questioned the viability of TRON's blockchain transition.

The company now trades under the ticker "TRON" on Nasdaq, marking a shift from its entertainment roots to a blockchain-focused treasury strategy. However, total value locked (TVL) in TRON's ecosystem dipped to $5.7 billion, further dampening investor sentiment. The $100 million reverse merger failed to generate sustained bullish momentum, highlighting the challenges of backdoor listings in volatile markets.

Tron Surpasses Cardano in Market Cap as Justin Sun Prepares Nasdaq Debut

Tron (TRX) has overtaken Cardano (ADA) to claim the ninth-largest cryptocurrency by market capitalization, fueled by a 30% surge in daily trading volume to $1.64 billion. The milestone coincides with Tron Inc.'s impending Nasdaq debut through a reverse merger with SRM Entertainment, trading under the ticker "TRON." Justin Sun, the controversial founder, will ring the opening bell.

TRX gained 12% over the past week while ADA dropped 10%, flipping their rankings. The token now boasts a $28.8 billion market cap, reflecting heightened investor interest ahead of its public listing. Tron's recent utility upgrades and Nasdaq narrative appear to be driving momentum.

JUST (JST) Price Prediction 2025-2030: Analyzing Growth Potential on TRON Ecosystem

Just (JST), the utility token powering TRON's ecosystem of DeFi tools, currently trades at $0.0369 amid a 4.36% daily decline. Analysts project bullish trajectories, with price targets reaching $0.0829 by 2025 and potentially $0.23 by 2030. The protocol's diversified suite—including stablecoin platform JustStable and lending protocol JustLend—demonstrates robust adoption, processing significant transaction volumes.

Market capitalization stands at $365 million against a fixed 9.9 billion token supply. Historical data reveals volatility extremes: JST peaked at $0.2083 in April 2021 before bottoming at $0.0047 during May 2020's market turmoil. The transition to delegated proof-of-stake consensus has strengthened network efficiency, though competition in the oracle and DEX sectors remains fierce.

Will TRX Price Hit 1?

Based on current technicals and market conditions, TRX would require a 218% rally from current levels to reach $1. Key factors to watch:

| Factor | Bullish Case | Bearish Case |

|---|---|---|

| Technical Pattern | Golden cross forming | MACD still negative |

| Ecosystem Growth | JUST token adoption | Ruvi AI competition |

| Market Position | Surpassed Cardano | Nasdaq debut volatility |

'While $1 seems ambitious short-term,' John observes, 'a sustained break above $0.33 could open the path to $0.50 initially. The 2025 roadmap execution will be crucial for higher targets.'